Ways of charitable giving

Guide to donating stocks and mutual funds

Giving stock, mutual fund shares or other non-cash assets to charity can be an effective strategy for donors looking to make a significant philanthropic impact while also unlocking additional tax benefits over cash donations.

Here’s what you need to know about making stock and other non-cash donations to the charitable causes of your choice:

- How to donate stock to charity

- How to donate mutual fund shares to charity

- Benefits of donating stock and mutual fund shares

- How to claim charitable tax deductions on stock and mutual fund shares

- Frequently asked questions

This content is specific to U.S. tax law – refer to IRS Publication 526 for more information and official guidance. You should consult with a financial advisor or tax professional for advice on your individual situation before making any investment decisions.

How to donate stock to charity

If you’re interested in donating stock, first confirm with the charity of your choice that they are able to accept the donation. Many organizations, including GiveDirectly, are able to accept donations made via stock.

There are generally a couple of ways you can donate stocks, depending on how the assets are held:

1. Physical stocks

If your stocks are held as a physical certificate, you’ll need to officially transfer ownership by providing a “guaranteed” or verified signature in the presence of a transfer agent, usually a broker or banker. You should confirm with the charity before pursuing a transfer of physical stock to confirm their preferred transfer process.

2. Digital, or broker-held stocks

Stocks issued recently are typically held digitally in a brokerage account. There are general guidelines provided by the Financial Industry Regulatory Authority (FINRA) on how stock transfers must be handled, which involve completing a Transfer Initiation Form (TIF). Your charity of choice should be able to provide their account information for your broker to complete the transfer.

How to donate mutual fund shares to charity

Similarly to donating stock, first confirm with the qualified charity of your choice that they are able to accept your gift of mutual fund shares. Many organizations, including GiveDirectly, are able to accept donations made via mutual fund shares.

Provided your mutual fund shares are held digitally, here’s the information you will likely need to provide so the charity can establish a receiving account for the shares:

- Name of the delivering firm, or broker that holds the fund

- Account number at the delivering firm

- Share quantity

- Fund symbol

Benefits of donating stocks and mutual fund shares

If you hold stocks and/or mutual fund shares, itemize your tax deductions, and intend to donate to an IRS-qualified charity, there may be advantages to donating shares versus donating cash for both you and the charity.

1. You may be eligible to take a tax deduction

Current IRS guidance specifies that donors can write off, or deduct, the fair market value of any noncash donations (including stock and mutual fund shares held for over a year) to qualified charities at up to 30% of your annual adjusted gross income (AGI). While the allowable deduction amount is higher for cash donations at up to 60% of your AGI, it can still be more beneficial to donate the investment assets for the reasons below.

2. You can generally avoid paying capital gains tax

If the value of your shares has appreciated in the year(s) since you acquired them, any profit you’d earn from selling those shares would be subject to capital gains tax at up to 20%, depending on your income and filing status. Donating those appreciated shares instead will help you avoid the capital gains tax on selling your securities. This could be a potentially advantageous option to consider if you’re looking to offset a portion of your overall capital gains tax liability following a liquidity event, like an IPO.

3. The tax savings could enable you to make a larger donation

Since neither you nor the charity will owe capital gains tax on a qualifying donation of stock or mutual fund shares, donating shares directly would maximize the value of your gift versus liquidating those shares and donating the cash proceeds.

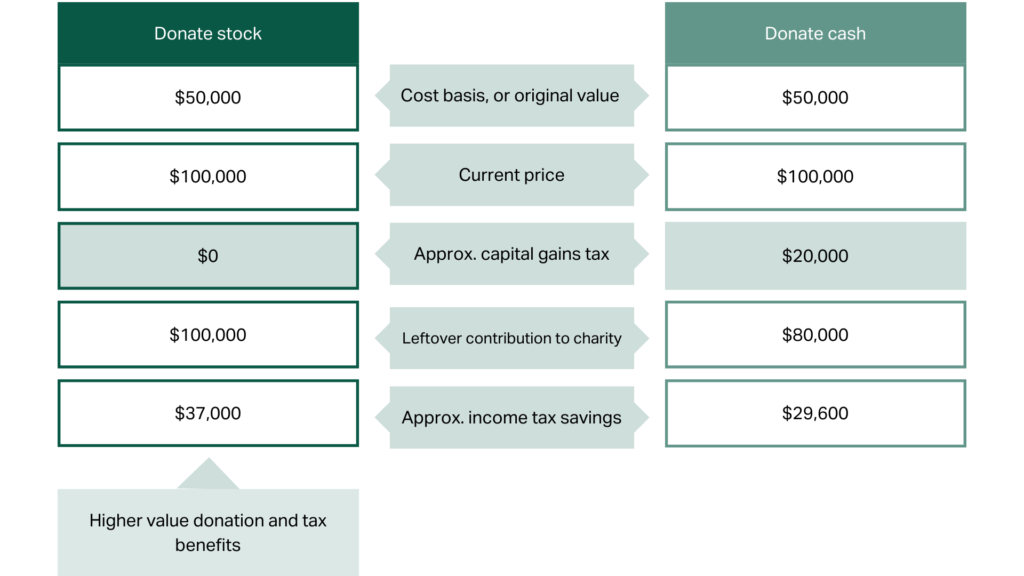

Here’s a hypothetical example of the difference across tax benefits and total donation amounts between stock and cash gifts.

Note that the tax treatment for donating shares of individual stocks and shares in a mutual fund is currently the same.

How to claim tax deductions from gifts of stock and mutual fund shares

Here’s an overview of the current IRS guidance on how to write off non-cash donations if your itemized deductions exceed the standard amount ($12,950 for single filers and $25,900 for joint filers in 2022):

- If your total non-cash donations are under $500 for the year: Report your contributions on Schedule A, Form 1040 on line 12.

- If your total non-cash donations are between $500 and $5,000 for the year: Report your contributions on Form 8283 which can be attached to your Form 1040. You may need to complete Section A of Form 8283 to report non-cash donations of publicly traded securities and those for which you claimed a deduction of $5,000 or less per item.

- If your total non-cash donations exceed $5,000 for the year: Report your contributions on Section A and/or Section B on Form 8283, depending on the type of securities donated. You’ll need to complete Section B for each qualifying charity and request that the charity complete Part V of Section B.

Note that due to the “carryover rule”, you have up to five years to claim, or carry over, any charitable contributions that are ineligible for deductions in the current year that exceed your allowable income limits.

This content is for informational purposes only and should not be construed as legal, tax, investment, financial, or other advice. Nor does this information constitute an endorsement or recommendation of any financial institution or an offer to buy or sell any securities or other financial instruments. The investments or other strategies mentioned herein do not take into consideration your particular investment objectives, financial situation or needs and may not be suitable for you. You must make an independent decision regarding any financial or investment strategies mentioned herein and should consult a legal, financial or investment advisor before making any financial decisions.

FAQs about donating stocks and mutual fund shares

Is it better to donate stocks or cash to charity?

It depends on your situation, but under some circumstances donating securities directly versus liquidating and donating the cash to qualified charities could be more advantageous for you and the charity.

What happens when you donate stock to charity?

Charities may process stock donations differently. At GiveDirectly, we liquidate gifts of stock and mutual fund shares soon after receipt in order to commit and deliver the funds to people in need as quickly as possible.

Can I donate mutual fund shares to charity?

Yes, many charities – including GiveDirectly – can accept gifts of mutual fund shares. You may be eligible to receive a tax deduction on your donation as well.

Can I donate stocks I’ve held for less than a year?

Yes. Securities sold after being held for under a year are typically subject to ordinary income taxes, but by donating these securities you may be eligible to claim the acquisition price, or cost basis, less fair market value. Refer to US Code 170 for more information.

How do I report stock donations on my tax return?

Depending on the total amount of non-cash donations you’ve made that year, you’ll need to report your charitable contributions on IRS Form 1040 and/or Form 8283 to claim a deduction.

How long does it take to transfer stocks to charity?

While the timing may vary depending on the brokerage firms involved, a typical stock transfer will take about a week according to FINRA.

How long does it take to transfer mutual fund shares to charity?

While the timing may vary depending on the brokerage firms involved, transferring mutual funds can take significantly longer than transferring stocks.

I donated stocks to charity 4 years ago but was unable to take a deduction at the time as I had exceeded my allowable deduction limits. Can I still claim the deduction?

Yes – under the carryover rule, you’re able to use charitable deductions up to five years after the donation.

When is the best time to donate stock?

While you can donate stocks at any time, keep in mind that your broker may be busy processing transactions in December – waiting until the end of the year may put you at risk of missing a tax deduction if your donation processing is delayed.

How do I start the process of donating stock to charity?

You should first establish whether the charity can receive stock donations via a brokerage account. Some charities like GiveDirectly have this information on their websites, while you may need to contact others. Once you have the brokerage account details, you can send this to your broker to initiate the transfer.

There are third party services which can do this on your behalf, but they often take fees that could reduce the value of your donation.

What’s the most tax efficient way of donating a stock investment which is currently sitting at a loss?

It’s generally more tax efficient to sell the stock at a loss and then donate the proceeds to charity. This will generally allow you to claim the capital loss and also receive a charitable deduction for the value of your donation.

How can I donate shares to GiveDirectly?

To make a tax-deductible donation of publicly traded stocks to GiveDirectly, you can transfer the shares to our brokerage account.

- Account name: GiveDirectly, Inc.

- Account # 220-66222

- DTC # 0352

- Bank name: J.P. Morgan Clearing Corp.

Please contact us at info@givedirectly.org with any questions on ways to give.