Ways of charitable giving

Guide to charitable tax strategies

Donating to charity can both unlock significant tax benefits for donors and make a positive impact on those in need.

Here’s an overview of deductions, write-offs and tax-smart donation strategies to help you understand how to maximize your philanthropic impact while reducing your annual gross income and overall tax exposure.

- How to claim tax write-offs for donations

- U.S. contribution limits, deadlines and tax law changes in 2023

- How to maximize your charitable tax deductions

- Frequently asked questions about charitable tax strategies

This content is specific to U.S. tax law – refer to IRS Publication 526 for more information and official guidance. You should consult with a financial advisor or tax professional for advice on your individual situation before making any investment decisions.

How to claim tax write-offs for donations

According to the IRS, you may deduct charitable contributions of money or non-cash assets made to qualified charitable organizations in a given tax year if you itemize your deductions.

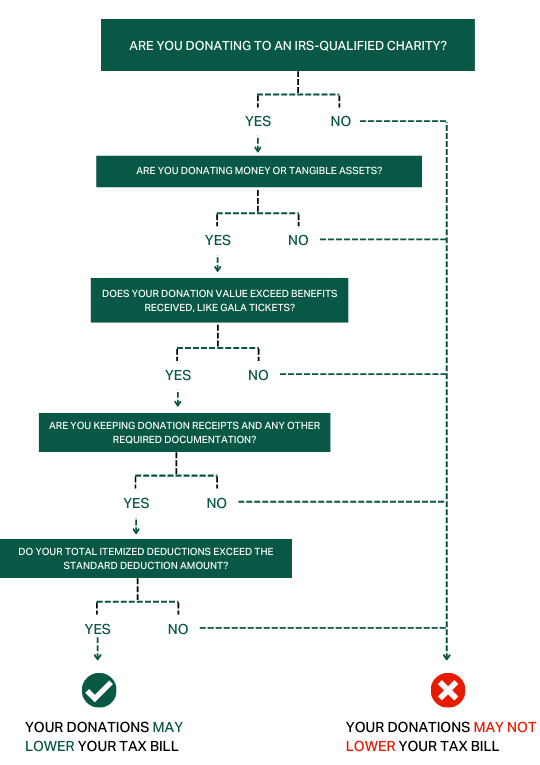

GiveDirectly and other 501(c)(3) public charities qualify for tax deductions. You can use the IRS’ Tax Exempt Organization Search tool to confirm the tax eligibility status of your preferred charity, and check out the graphic for general guidance on whether your donations may be able to help lower your tax liability.

How much can I deduct from donations?

There is no specific dollar limit on deductions from charitable contributions. Generally, you can deduct your donations up to 60% of your annual gross income (AGI), but this percentage may be lower depending on the form of contribution (cash vs. non-cash donations) and the type of charitable organization. Non-cash assets like long-term appreciated stocks and property that you’ve held for more than a year are typically deductible at fair market value up to 30% of your AGI.

Check out Fidelity Charitable’s charitable tax savings calculator to estimate how much you may be able to save on taxes through your donations and consult a financial or tax professional for advice on your individual situation.

Who can claim charitable deductions?

Typically, only individuals who exceed the standard deduction amounts and choose to itemize their deductions are eligible to claim a tax write-off on qualified donations. This eligibility criteria was temporarily lifted in 2021 due to the passage of the CARES Act but was only applicable for the 2021 tax year. See below for U.S. contribution limits, deadlines and other applicable tax law changes for the 2022 and 2023 tax years.

How can I claim charitable deductions?

You or your tax preparer will need to fill out the IRS’ donation form for taxes (Schedule A – Form 1040) to include with the rest of your tax return in order to claim charitable tax write-offs. You’ll need to keep track of your donation receipts or other qualifying documentation. For cash donations, this could include a bank statement, credit card statement or canceled check.

Where there are no other records or evidence of the donation, a donor will need to obtain a written acknowledgment from the charitable organization. The donor is responsible for requesting and obtaining the written acknowledgement from the charity. For more details see IRS Publication 1771: Substantiation.

For non-cash charitable contributions, you’ll need to fill out Form 8283 and may need to have your contribution appraised by a qualified appraiser to estimate the value of the deduction or provide additional documentation for certain contribution types. The IRS provides more detail on the types of contributions that require an appraisal. Where no appraisal has been carried out, the IRS can deny the deduction under some circumstances.

U.S. Contribution Limits, Deadlines and Tax Law Changes in 2024

Wondering what the tax rules for charitable contributions are in 2024? Here’s what you need to know to plan your giving this year:

Standard tax deduction amounts: Standard tax deductions are increasing due to inflation. For the 2024 tax year, which will be filed in 2025, single filers can claim a $14,600 standard deduction. Married couples filing jointly can claim a $29,200 standard deduction.

Deduction limits for charitable donations: If the total amount of your itemized deductions exceeds the standard deductions above, in 2024 you will generally be eligible to deduct up to 60% of your adjusted gross income (AGI) for cash donations and generally up to 30% of AGI for donations of non-cash assets. You may also be eligible for a charitable contribution carryover, also known as tax carryforward, which allows you to claim any donation amounts above those deduction limits for up to five subsequent tax years.

Deadlines for charitable donations: The last day to make charitable donations in 2024 is December 31, 2024. You must make donations by 11:59 PM on December 31 in your local time zone to ensure you are earning a tax deduction in 2024.

How to maximize your charitable tax deductions

Here are some common tax-smart giving strategies to consider as your plan your donations:

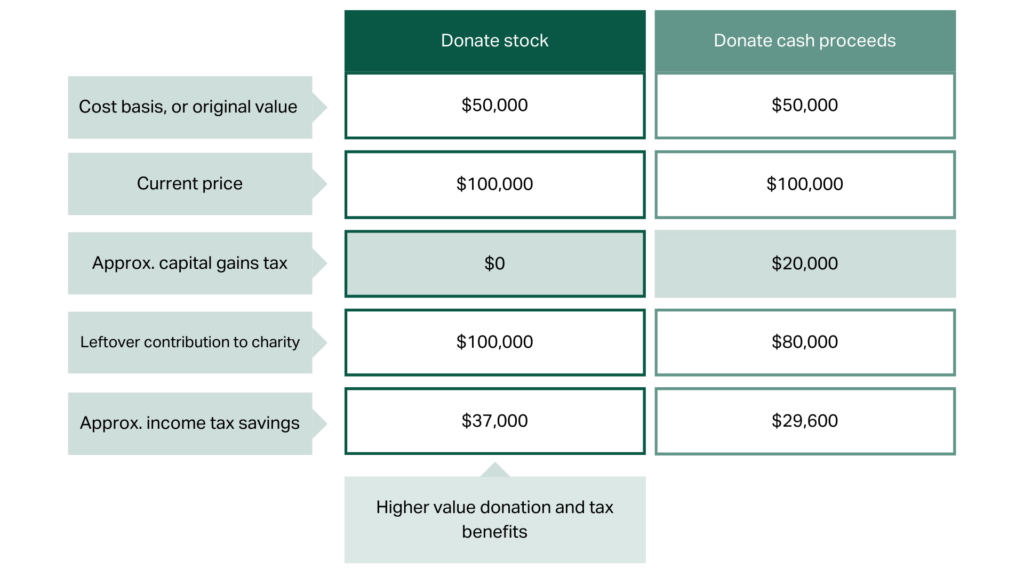

1. Donate non-cash appreciated assets like stocks or bonds instead of cash

If you have held an appreciated asset for more than a year, you may be able to eliminate paying capital gains tax you would incur if you sold the asset and then donated the cash proceeds to charity. This may both increase your tax savings and the impact of your donation.

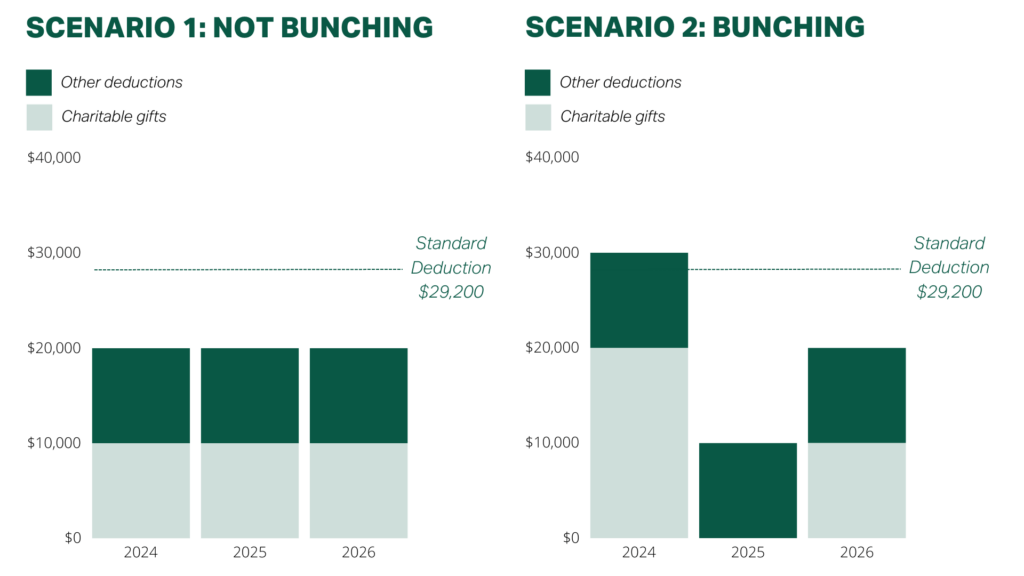

2. Bunch donations into a single tax year

If you are on the border of taking the standard deduction vs. itemizing deductions, you can consider frontloading or bunching multiple years of charitable donations into a single tax year to meet eligibility requirements to itemize in one year and take the standard deduction in the next year.

For example, if you are filing jointly, plan to make $10,000 in donations per year and have $10,000 in other deductions in 2024, you could consider making $20,000 in total contributions across 2024 to earn eligibility to write-off those donations. In that scenario, you could incrementally reduce your AGI in 2024 ($20,000 less the $29,200 standard deduction for joint filers) and take the standard deduction in 2025.

3. Research other tax-efficient forms of charitable giving

Depending on your financial situation, you may benefit from giving through qualified charitable distributions (QCDs), a donor-advised fund, charitable remainder trust or charitable lead trust, or a family foundation.

This content is for informational purposes only and should not be construed as legal, tax, investment, financial, or other advice. Nor does this information constitute an endorsement or recommendation of any financial institution or an offer to buy or sell any securities or other financial instruments. The investments or other strategies mentioned herein do not take into consideration your particular investment objectives, financial situation or needs and may not be suitable for you. You must make an independent decision regarding any financial or investment strategies mentioned herein and should consult a legal, financial or investment advisor before making any financial decisions.

FAQs about charitable tax strategies

Can I claim charitable deductions from donations to any nonprofit?

It depends. While the terms 501(c)(3) and nonprofit are used interchangeably, only nonprofits designated as 501(c)(3)s by the IRS are tax-exempt organizations where your donations are eligible to claim tax write-offs.

Can I claim tax deductions on charitable donations over $1 million?

While there is no maximum write-off for donations, your eligible deductions may depend on factors such as your annual gross income (AGI) and form of giving (cash vs. non-cash contribution).

Can charitable contributions reduce short term capital gains tax?

If you donate stock or other securities that have been held for less than a year, you may be eligible to claim the securities’ cost basis less fair market value. Refer to US Code 170 for more information.

Do I need an appraisal for all non-cash charitable contributions?

No – publicly-traded stocks, bonds, and mutual funds typically do not need to be appraised in order for your donation to qualify for a tax deduction.

Does my tax bracket matter when making charitable deductions?

While your tax bracket doesn’t impact your ability to claim tax write-offs on charitable contributions, you may only be eligible to deduct up to 60% of your AGI with qualified donations.

What is the maximum tax write-off without a donation receipt?

For all donations, you will need evidence of the transaction (such as a credit card or bank statement).

For donations of $250 or above, you will also need a donation receipt or written acknowledgment from the charity which includes the amount, date and a statement that no goods or services were provided in return for the donation. See IRS publication 1771 for details on the requirements for written acknowledgement.

What is the Pease limitation on charitable contributions?

The Pease limitation was repealed under 2017’s Tax Cuts and Jobs Act, which notably introduced significant increases in standard deduction amounts. The Pease limitation had previously put a cap on how much high-income taxpayers could claim on itemized deductions. The Pease limitation could potentially return after the TCJA expires in 2025.

Can I claim tax deductions for charitable donations to foreign charities?

Contributions to foreign organizations are generally not tax deductible. If they are not on the list of the IRS’s approved charities, then the donation will not be deductible.