Recommended by:

Cash lets recipients define their own needs.

Cash transfers empower people to define their own needs, rather than relying on donors thousands of miles away to choose for them.

It’s also effective: 165+ studies show cash’s impact.

165+ research studies show a range of positive impacts, including earnings, assets, health, nutrition, and more.

And it’s transparent –– 90¢ of each dollar donated is delivered to recipients.

Unlike physical donations, cash doesn’t require complex supply chains, intermediaries, or bureaucratic administration.

We’ve delivered $400M+

in the last decade

GiveDirectly is the leading global NGO specialized in delivering digital cash transfers. We’ve worked in challenging contexts across 8 countries, from Houston after Harvey to the most remote parts of Uganda, and launched 15 experimental evaluations (RCTs) with independent researchers documenting the impacts on recipients and on the local economy.

As seen in:

Frequently asked questions

DONATIONS

Is my donation tax deducatable?

Yes, donations are tax-deductible in the United States. GiveDirectly is a registered 501(c)(3), and our U.S. federal EIN is 27-1661997.

How much of my donation does a recipient receive?

To date, across our standard retail programs, 90 cents of every dollar donated was delivered to recipients. The remainder was spent on key aspects of our operations: identifying the recipients most in need, preventing fraud, and ensuring a high bar of customer service.

How can I donate? (Card, Check, PayPal, etc.)

You can donate via our secure donation page. Once you complete the first step you will be able to choose a donation method. We accept:

- All major credit and debit cards

- PayPal

- Checks

- Wires

- Stocks

- BTC, ETH cryptocurrencies

Can I choose to whom to give?

No; we let donors choose which programs to donate to, but not individual recipients. Practically speaking, if we did the latter we would risk being regulated as a money transfer service and losing our charitable status. Philosophically, we aim to target the poorest possible recipients, and not those with compelling profiles or narratives. Finally, it keeps costs down.

When identifying recipients for programs we aim to find people living in the most extreme poverty while using criteria that are simple, fair, cost-effective, and difficult to game. Currently, our default is to locate extremely poor villages using poverty data from national surveys, and then enroll all households in the village. For programs with specific targeting requirements (e.g. refugees, contactless programs) we use a range of identification methods, including obtaining lists from partners (gov’ts, NGOs, or community-based organizations) or partnering with apps. In the past, we have also selected the poorer households within villages using simple criteria, e.g. enrolling families living in homes with thatched roofs and not those with metal roofs, and also experimented with a wide range of other targeting approaches including community-based methods, points-based systems such as the Progress out of Poverty Index (PPI) and the Multidimensional Poverty Index (MPI); subjective assessments; and various blends of these approaches.

OPERATIONS

Who is GiveDirectly?

GiveDirectly is the first — and largest — nonprofit that lets donors like you send money directly to the world’s poorest. We believe people living in poverty deserve the dignity to choose for themselves how best to improve their lives — cash enables that choice.

Since 2009, we’ve delivered $400M+ in cash directly into the hands of over 900,000 families living in poverty.

Where does GiveDirectly operate?

We currently work in 7 African countries: Kenya, Rwanda, Liberia, Malawi, DRC, Morocco, and Togo. We chose to work in these countries because they have large populations that are living in extreme poverty and yet are reachable through electronic payment systems, and we were able to raise funds to work there. We have also delivered disaster response programs in the United States and launched a U.S. coronavirus response fund. We consider working in additional countries only when there is a strong argument that we can increase our impact by enough to justify the fixed setup costs.

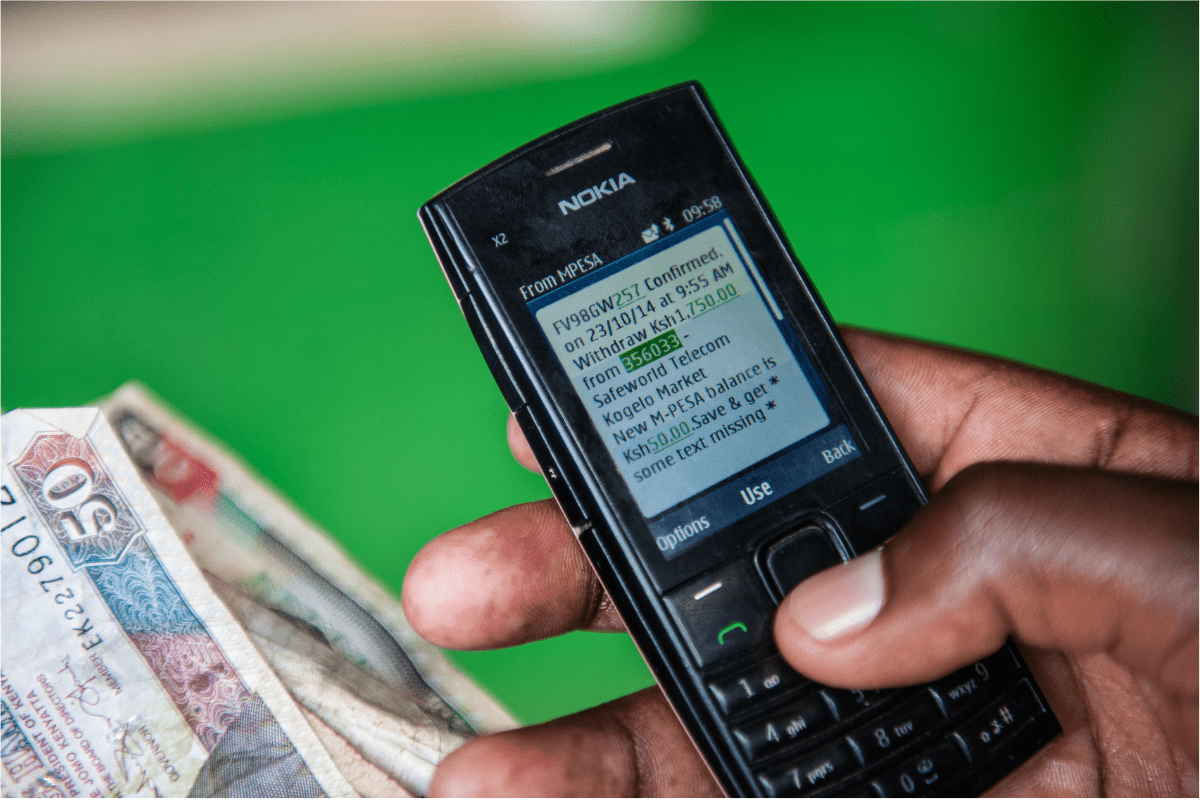

How exactly is the transfer made?

We send transfers using electronic payments services, such as M-Pesa (operated by Safaricom) in Kenya, MTN mobile money in Uganda, and MTN in Rwanda. In each case, we either collect account information from recipients (if they are already enrolled) or walk them through the process of opening accounts, which may include obtaining appropriate identification documents. When we transmit electronic money to the recipient’s account, they receive a text message notifying them that they have been paid. Recipients can then exchange their mobile money for physical cash anywhere in the payment providers’ network of mobile money agents. Agents are often local shopkeepers, but can also be petrol stations, supermarkets, courier companies, cyber cafes, and even banks. Recipients can also use their money to directly pay merchants who accept it as a form of payment.

How do recipients use the transfers?

By design, cash transfers let recipients use money for whatever is most important to them. Innovations for Poverty Action’s evaluation of our transfers in Kenya found increases in expenditure across all categories measured, including food, medical and education expenses, durables, home improvement, and social events. It also found large increases in income and in asset holdings, in particular livestock, furniture, and iron roofs. In addition to this research on GiveDirectly’s transfers, there is a large body of research from around the world documenting the impacts of cash transfers on low-income households. See GDLive for a good idea of how cash is being spent in real time.

How do you prevent fraud?

We use a mix of prevention, detection, and auditing techniques to manage fraud. These include, for example, defined staff roles, spot checks of data captured in the field, remote GPS coordinate checks, and independent follow-up calls with recipients, among others. We use government-issued IDs and other documents to confirm the recipients’ place of residence.

Do recipients spend on alcohol or tobacco?

Innovations for Poverty Action’s evaluation of our work in Kenya found no increase in expenditure on tobacco, alcohol, or gambling. This is consistent with a substantial body of research on the effects of cash transfers, which has found that, if anything, recipients spend less on alcohol and tobacco after receiving cash transfers (Evans and Popova, 2016).

Why not make micro-loans?

The evidence on the impact of cash transfers is far stronger than that for micro-loans, whose impacts have generally been below expectations. We think that micro-loans are likely beneficial for the poor, but given the evidence, see no reason to incur the added costs of administering them.

We suspect that the disappointing track record of micro-loans may have to do with their structure. These loans often bear high interest rates, reflecting the high costs of administering and monitoring them, which in turn limit their benefit to borrowers. They also tend to have short-term structures and require borrowers to begin making repayments shortly after borrowing. These features make micro-loans less useful for financing the kinds of long-term investments (e.g. education or durable goods) that recipients often make with grants.