Ways of charitable giving

Guide to donating cryptocurrency

Since an anonymous Bitcoin philanthropist donated $55 million through the Pineapple Fund in 2017, donating crypto has become an increasingly popular form of charitable giving.

Donating currencies like Bitcoin, Ethereum, and others to charity can be a great way for crypto holders to maximize your social impact on the charitable causes of your choice while claiming tax benefits on your donation.

Here’s what you need to know if you’re considering making a charitable contribution with your cryptocurrency:

- How to donate crypto

- Tax benefits of donating crypto

- How to claim deductions on crypto donations

- Frequently asked questions about donating crypto

To date, GiveDirectly has raised over $25M from the crypto altruist community. Here’s a list of our accepted currencies and wallet addresses if you’d like to give crypto to people in need.

This content is specific to U.S. tax law – refer to IRS Publication 526 for more information and official guidance, and please verify that any guidance reflects the latest crypto rules and regulations. You should consult with a financial advisor or tax professional for advice on your individual situation before making any investment decisions.

How to donate crypto

The easiest way to donate crypto is to send it directly to any IRS-qualified 501(c)(3) charity that accepts your currency.

If the public charity of your choice does not accept crypto donations, you could consider donating your crypto to a donor-advised fund and have your DAF sponsoring organization convert your cryptocurrency tax-free and then direct a grant to the charity of your choice. Note that charitable contributions to DAFs are irrevocable.

Tax benefits of donating crypto

Crypto can be donated to charity like any other investment asset and depending on your situation, donating Bitcoin or other cryptocurrencies can be a tax-efficient method of giving. Here are some advantages of donating crypto to consider:

1. Crypto donations qualify for tax deductions

The IRS treats cryptocurrency investments like other capital or non-cash assets, so crypto donations to IRS-qualified charities are tax deductible up to 30% of your adjusted gross income (AGI) if you itemize.

Here is the official IRS guidance on calculating and reporting crypto deductions, which vary depending on how long you’ve held the currency at the time of donation and may be subject to the 30% AGI cap above:

- If you’ve held your crypto for over a year: the deduction amount typically equals the fair market value of the currency at the time of donation.

- If you’ve held your crypto for under a year: the deduction amount typically equals the lesser of your cost basis (your original purchase price plus any costs incurred when buying the asset) or the currency’s fair market value at the time of donation.

Note that you may need to get a qualified appraisal to determine the fair market value of your crypto donation and you may need to obtain and submit the charity’s acknowledgement of the crypto donation when filing your taxes.

For coins with high levels of market liquidity (such as the Top 100 Cryptocurrencies by Market Capitalization), fair value should be relatively simple to determine as there is market data readily available. However for unique assets like NFTs with less liquidity and no market data, an appraisal will be much more complex.

There is no standard practice or specific guidance from the IRS on NFT appraisals – but with the rise in NFT donations, this is becoming an important issue.

2. Crypto donations are not subject to capital gains tax

Anytime you convert crypto to fiat or use it to buy goods or services, it becomes a crypto-taxable event where you may be subject to pay taxes on the appreciation of your currency since you acquired it.

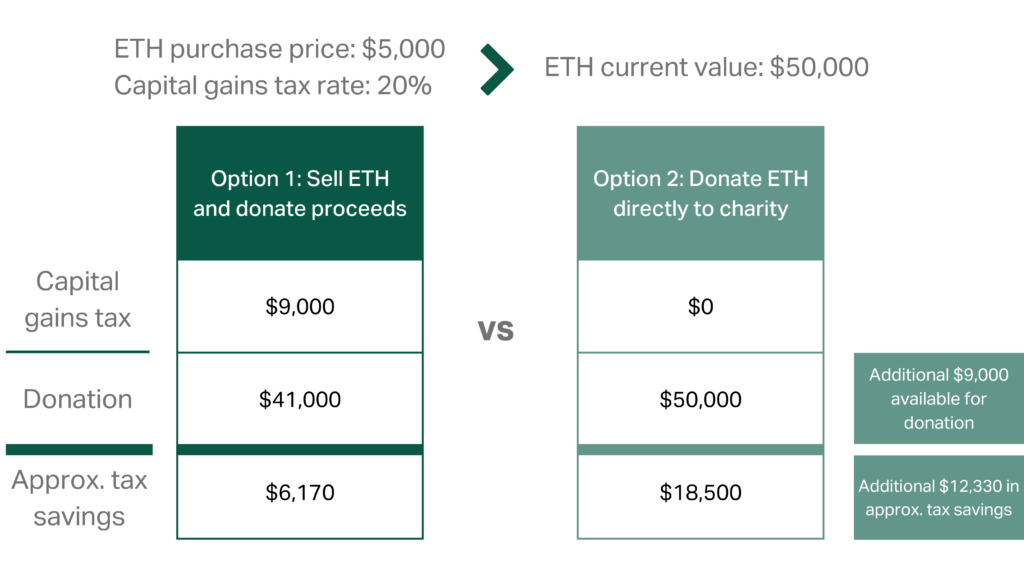

However, if you choose to donate crypto held for over a year, you shouldn’t owe any taxes on the gains or currency appreciation since you purchased it. By reducing or eliminating your capital gains, you’ll be able to maximize the value of your donation versus converting your crypto to fiat, paying the capital gains tax and then donating the money to charity.

Note that donating crypto held for under a year can still help you avoid capital gains taxes, but your deduction will be limited to the lesser of their fair market value and the amount you paid for the coin(s).

How to claim deductions on crypto donations

If you itemize and would like to claim a tax write-off on donations of cryptocurrency, the process for reporting your donation to the IRS varies based on the size of your donation:

- For crypto donations under $250: you’ll need to complete Schedule A of Form 1040 and provide a donation receipt from the charity which includes the organization’s name, address, and both the date and amount of the donation.

- For crypto donations over $250 and up to $500: you’ll need to complete Schedule A of Form 1040 and provide “written acknowledgement” from the charity to substantiate your donation, which includes the above receipt information, an estimate of the currency’s fair market value, and a note on whether any goods or services were exchanged for the donation.

- For crypto donations above $500: you’ll need to complete Section A of Form 8283 and provide written acknowledgement from the charity.

- For crypto donations exceeding $5,000: you’ll need to complete Section B of Form 8283, provide written acknowledgement from the charity, and will additionally need a signed declaration by a qualified appraiser.

Refer to 26 CFR § 1.170A-13 – Recordkeeping and return requirements for deductions for charitable contributions for more information.

This content is for informational purposes only and should not be construed as legal, tax, investment, financial, or other advice. Nor does this information constitute an endorsement or recommendation of any financial institution or an offer to buy or sell any securities or other financial instruments. The investments or other strategies mentioned herein do not take into consideration your particular investment objectives, financial situation or needs and may not be suitable for you. You must make an independent decision regarding any financial or investment strategies mentioned herein and should consult a legal, financial or investment advisor before making any financial decisions.

FAQs about donating crypto

Can I donate cryptocurrency to GiveDirectly?

Yes, here is a list of cryptocurrencies we currently accept:

- Bitcoin

- Ethereum

- Celo

- Dogecoin

- Ripple

- ADA/Cardano

- Litecoin

- Stellar

- Chainlink

- FTT

- Solana

- Shiba Inu

- USD Coin

Want to give other currencies? Reach out to info@givedirectly.org and we’ll send back an address.

How do charities process cryptocurrency donations?

It depends. At GiveDirectly, we are able to receive and process cryptocurrencies directly through our wallet. Other charities may use a third-party crypto payment processor like The Giving Block.

Can I donate cryptocurrency earned as a mining reward to charity?

Yes. Note that for tax purposes, cryptocurrency earned through mining may be treated as income rather than a capital asset.

Can crypto donations be carried forward?

Yes – if the tax deduction on your crypto donation exceeds your allowable deductions per year (generally up to 30% of your adjusted gross income), you may be able apply the remaining deduction under the five-year carryover provision.

Can I donate non-fungible tokens (NFTs) directly to charity?

Maybe – while the IRS currently treats NFTs like non-cash contributions (like other cryptocurrencies) for donation-related tax purposes, there may be additional complexities around transferring ownership of NFTs and appraising NFTs when making your charitable contribution. NFT donations typically involve donating the proceeds of an NFT sale to charity.

Can I donate cryptocurrency anonymously?

Yes, though you will need to share your contact information with the charity or donor-advised fund in order to claim a tax deduction on your donation.

Can I harvest losses on cryptocurrency by donating them to charity?

No – generally, while you can take tax deductions on the fair market value of your crypto regardless of its appreciation or depreciation, you can’t currently reap any loss harvesting tax benefits by donating crypto to charity at a loss.

What’s the most tax efficient way of donating a cryptocurrency which is currently sitting at a loss?

It’s generally more tax efficient to sell the cryptocurrency at a loss and then donate the proceeds to charity. This should allow you to claim the capital loss and receive a charitable deduction for the dollar value of your donation.