Summary

- 📈 A one-time $1,000 GiveDirectly cash transfer generated 2.5x economic activity in rural Kenya.

- 💵 Most recipients spent locally, raising business revenue by 65% without causing major inflation.

- 🌍 Researchers are now running a study 10x larger in Malawi to test how cash scales as an economic stimulus.

One of the world’s largest cash studies found that GiveDirectly’s program, giving a one-time $1,000 cash transfer to 10,500 poor households in rural Kenya, led to 2.5x that amount in economic growth.

Now, we’re building on these results to launch the world’s biggest randomized controlled trial on cash, and asking even bigger questions to understand how cash impacts economies at scale.

Cash boosted the local economy because families spent close to home

Previous studies have measured “cash multipliers,” but this was the most rigorous to-date. The massive scale of the 2022 study – following more than 280,000 people and 11,000 businesses across 653 Kenyan villages – let researchers precisely trace how cash moves through an entire local economy.

Most of the cash we gave out didn’t leave the community, with ~80% of recipient spending staying within local markets.

This created a ripple effect in the economy: a family buys grain, the shopkeeper pays a grain miller for more, the miller hires another operator to stay open longer, and so on. Much of this new income is also spent locally, creating a flywheel effect. Read examples below:

🤝 Neighbors who didn’t get cash also earned more and lived better as businesses grew ↓

As recipients spent locally and nearby businesses grew, their neighbors who hadn’t received cash also saw their incomes and spending rise. Within a year, their progress nearly matched those who received cash: neighbors spent an extra $335 yearly, earned $225 more every year, ate better, and invested more in housing.1

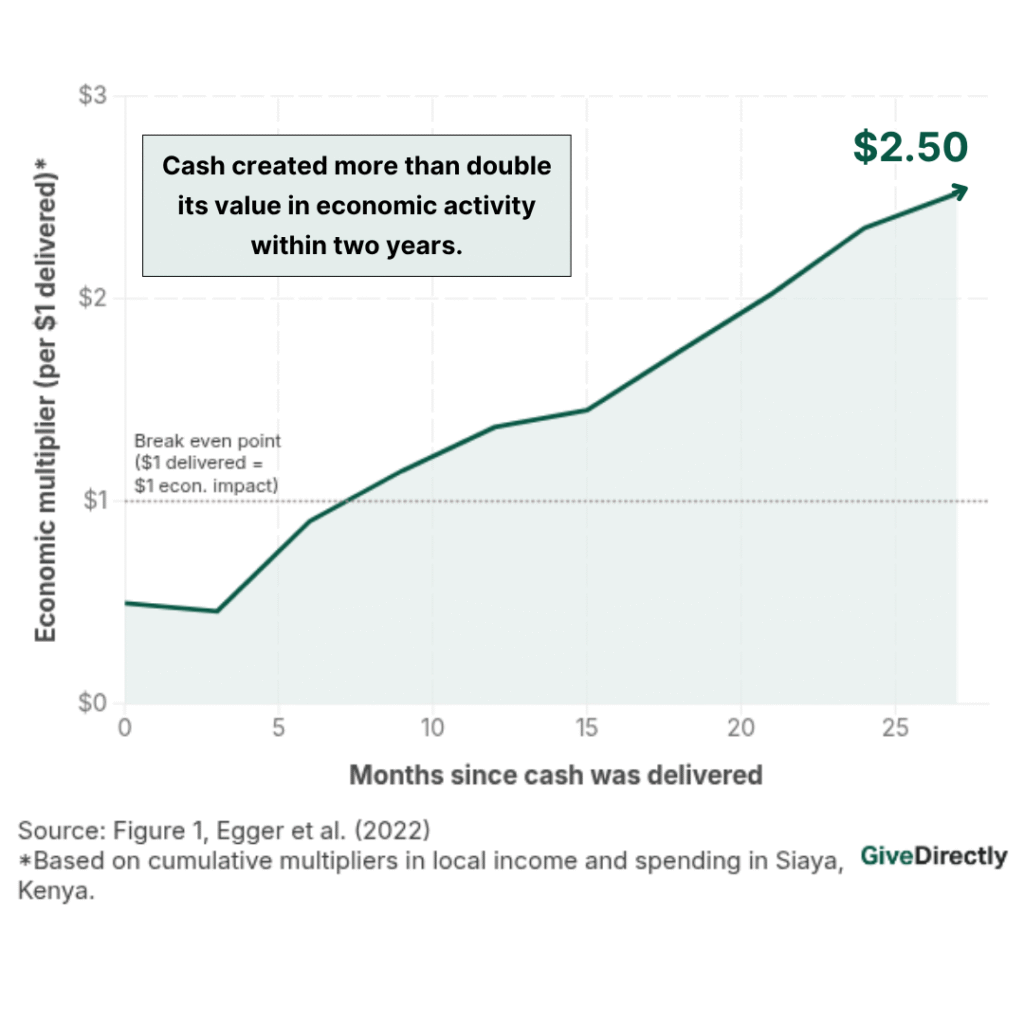

Every $1 delivered as cash grew the local economy by $2.50

All of this spending and hiring created a “multiplier”–growing the economy by more than what we initially gave out. By the end of the two-year study period, every $1 delivered had doubled its value into $2.50 in new economic activity and was still trending upwards.

This multiplier is unusually large–most government stimulus programs in high-income countries achieve just a ~1x multiplier.

📈 Click to read how the multiplier is calculated ↓

A multiplier shows how much total economic activity grows for every dollar delivered, counting not just what recipients spend, but also how much others earn as that money circulates through the local economy.

At the time, GiveDirectly was delivering cash only to the poorest households (those with thatched roofs), which let researchers measure both direct impacts and effects on neighbors. Researchers also varied how many nearby villages received transfers to track spillovers across communities.

Unlike most studies on cash, this one also surveyed nearly all local businesses, tracking their hiring, spending, and revenue. That showed how transfers impacted not only recipients, but also the businesses they shop at.

By combining these effects on households, businesses, and prices, researchers estimated the full local multiplier over time.

Cash caused nearly no inflation because businesses already had room to grow

In wealthier industrialized economies, when demand increases this rapidly, prices often rise too. However, in rural Kenya, a cash influx equal to 15% of local GDP led to a 65% increase in business revenue without causing significant inflation.

Average inflation was just 0.1%. The research team tracked prices monthly in 61 local markets for more than two years, covering over 70 everyday goods — from grains and vegetables to soap and nails — and collected more than 320,000 price quotes. Researchers noted minimal inflation across treatment and control markets: “We document statistically significant, but economically minimal, local price inflation. Average price inflation is 0.1% and even during periods with the largest transfers, price effects are less than 1% and precisely estimated across all categories of goods.”

💡 Researchers credit this low inflation to “slack” in the local economy ↓

This near-zero inflation in rural Kenya is likely thanks to what economists refer to as “slack.”

Before cash arrived, many businesses were operating at only about 60% of their potential output (e.g. a grain miller who only runs his machine half the day because he has few customers). When cash led to more customers, they could easily grow by staying open longer, hiring staff, and making better use of their existing resources, instead of raising prices.2

Take Makiloyi, the bicycle mechanic in Malawi pictured above. Before transfers, he often sat for hours without customers. Afterward, he was repairing six to eight bikes a day as more families could afford to buy them. He met the higher demand without having to increase his prices because there was existing “slack” in his day. With the extra income, his own family began building a home and investing in livestock, creating new demand for builders and traders in turn.

Next we’re testing if cash can transform entire regional economies

These promising Kenya results show cash can reshape local economies – sparking broad growth without raising prices.

But what happens if we try this at an even larger scale? What will carry over, and what might change?

We’re partnering with the same research team on a district-wide randomized controlled trial in Malawi, ~5x larger than the Kenya study in terms of share of regional GDP, to find out.

🔎 Growth in Kenya beat predictions; the Malawi study will test how far markets can stretch ↓

The researchers’ slack model predicted that our cash in Kenya would raise prices slightly and boost local economic growth moderately. The data showed prices stayed low as expected, but economic growth far exceeded what they’d predicted.

Our next test in Malawi goes further: delivering cash worth more than double the district’s GDP, a scale pushing beyond what current models can confidently predict.

Malawi will show us just how far cash can go

If prices stay stable even after a much larger cash injection, it would challenge long-held beliefs about what under-resourced markets can handle.

For that to happen, something else big would need to be at play—businesses becoming more efficient, more goods being made or flowing in from nearby areas, or something we haven’t seen yet. So we’re working with economists to track what’s changing and why.

These collaborations help us learn where—and under what conditions—large, one-time cash transfers can drive economy-wide growth. We don’t have the full picture yet, but our 2023 Malawi pilot suggests it’s possible: after giving over $52M to 85K adults across an entire sub-district (roughly a year of local GDP), prices rose by less than 1%, and most families exited extreme poverty.

If those results hold, it could reshape how economists and governments view cash—not just as a tool to relieve individual poverty, but as a way to grow entire economies.

Additional commentary

- World Bank (Berk Özler) – Who benefits from the indirect effects of cash transfer programs?

- IFPRI (James Allen IV, Ugo Gentilini) – Cash transfers and inflation: An overview of the evidence

- In this study, only the poorest households within villages—those with thatched roofs—received cash. Their neighbors, with sturdier homes, were relatively better off and more likely to run businesses or earn wages. When recipients spent locally, demand flowed to their neighbors as higher business income and wages. Recipients, meanwhile, saw larger gains in housing value because they started with less valuable homes and invested more in home improvements.

- Price changes were smallest for tradable goods (like soap and cement) and in better-connected markets, suggesting that integration with other markets and faster restocking helped keep inflation low. While market patterns aligned with slack models, researchers note that slack is likely one of several overlapping explanations for stable prices in Kenya. GiveDirectly is continuing to partner with macroeconomists as we scale up in Malawi, to understand the market-specific characteristics that drive higher or lower inflationary impacts.