Ways of charitable giving

Guide to charitable trusts

Charitable trusts, also known as “split-interest trusts”, can be a tax-efficient way to donate to a public charity or private foundation while generating income for you and potentially your loved ones or beneficiaries.

Here’s what you need to know if you’re considering making donations to a tax-exempt nonprofit through a charitable trust:

- What is a charitable trust

- Types of trusts and how to set them up

- Pros and cons of trusts

- Frequently asked questions about charitable trusts

This content is specific to U.S. tax law – refer to IRS Publication 526 for more information and official guidance. You should consult with a financial advisor or tax professional for advice on your individual situation before making any investment decisions.

What is a charitable trust

Charitable trusts are a form of irrevocable trust – meaning that they are typically not able to be modified or terminated after creation – that is established as part of a planned giving strategy to make donations to the charitable cause of your choice over an extended period of time. Once a trust is funded, the donor may be eligible to take a partial tax deduction on the amount of their contribution. Depending on the type of trust, the funds will then be distributed over time, both to an IRS-qualified charity or charities and back to the donor or their beneficiaries.

Types of charitable trusts

The most common forms of charitable trusts are charitable lead trusts and charitable remainder trusts (CRTs). Under both trust structures, payments can be distributed to two groups: charities and the donors themselves, or their beneficiaries. A major difference between these trusts is the timing and order in which distributions are made to the distinct charity and donor/beneficiary groups.

Charitable trusts are also known as “split-interest trusts” as the financial interest in the trust is divided between the charity and the trust’s donor or beneficiaries.

The tax benefits and implications typically vary between the trusts as well, so you should consult a financial, tax, or legal professional on whether a charitable trust is the right option for your individual circumstances.

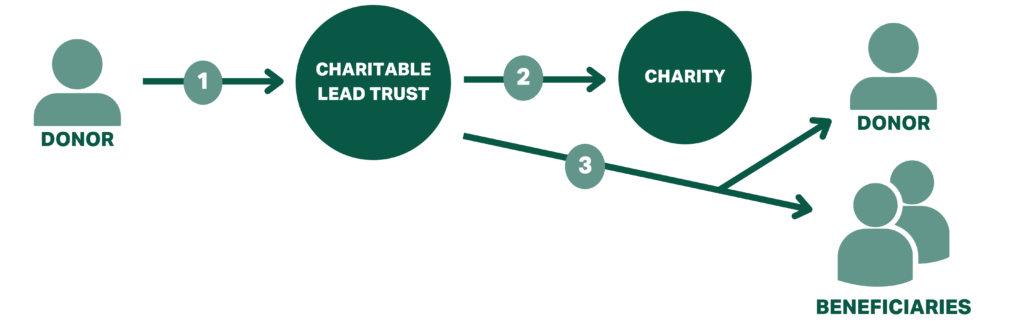

Charitable lead trusts

Under a charitable lead trust, a donor first contributes cash or non-cash assets like securities to fund the trust for a set period of time. During this term, the trust makes payments annually or on another set schedule directly to the donor’s qualified charity or charities of choice. Once the term is over, the remaining trust funds are distributed to the donor or their beneficiaries.

Here’s a general overview of how a charitable lead trust works and how to set it up:

1. Donor establishes the trust

You establish a charitable lead trust with the support of a qualified legal advisor or tax lawyer. Establishing the trust may involve specifying the term of the trust and any beneficiaries. Once established, you can make a cash or non-cash contribution to the trust.

2. Donor may be eligible take a partial tax deduction on their contribution

After the trust has been established and funded, you may be able to use your contribution to reduce some of your annual gross income (AGI) and take an immediate tax deduction. The size of your deduction may vary on a number of factors, including how much of the trust funds are considered “charitable interest” vs. “non-charitable interest”.

Charitable interest includes the funds which will be distributed to charity, and noncharitable interest includes any remaining funds which will be distributed to the donor or their beneficiaries at the expiration of the trust. Tax deductions are typically based on the value of the charitable interest, which is calculated as the current value of the scheduled payments to charity over the life of the trust. See the current IRS actuarial tables for more information on these present value calculations.

Note that the above refers to a grantor trust in which an eligible donor receives a tax deduction and subsequently owes taxes on future distributions made to themselves or their beneficiaries. Alternatively, charitable lead trusts can be structured as non–grantor trusts in which donors are not eligible to take an immediate tax deduction for the charitable interest but may offer additional advantages on beneficiary transfer taxes.

3. The trust distributes the “charitable interest” to qualified charities

The timing and structure of these payments may depend on whether the trust is established as a charitable lead annuity trust (CLAT) or a charitable lead unitrust (CLUT).

Under a charitable lead annuity trust, charitable payments are made on an annual basis as a fixed percentage of the initial fund amount. Under a charitable lead unitrust, the charitable payment is calculated as a fixed percentage of the current value of the trust. This will change the size of the charitable payment based on the rate of return for any investment assets in the fund.

For example, a contribution of $500,000 to a 10% CLAT means the charitable distributions will be $50,000 each year for the life of the trust. The same contribution to a 10% CLUT composed entirely of investments earning 5% in the second year of the trust means the charitable distributions will be $50,000 in the first year and $52,500 in the second year.

4. After the term, the remaining trust funds are distributed to the donor or their beneficiaries

Once the predetermined term of the fund is over, the remaining assets or “non-charitable interest” is distributed. The tax implications of this distribution depends on whether the trust was set up as a grantor or non-grantor trust. One of the advantages of a non-grantor trust (which does not receive an immediate tax deduction) is that there may be minimal or no transfer taxes involved at this stage.

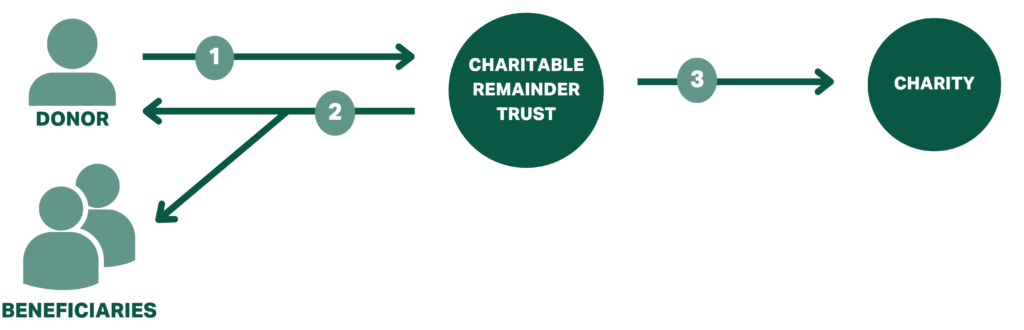

Charitable remainder trusts

In contrast, charitable remainder trusts (CRTs) have a different distribution sequence than charitable lead trusts (CLTs). Under a CRT, a donor contributes cash or non-cash assets to fund the trust. During the term of the trust, payments are made to the donor or their beneficiaries and once the term is over, the remainder is distributed to qualified charities.

Here’s a general overview of how a charitable remainder trust works and how to set it up:

1. Donor establishes the trust

You establish a charitable remainder trust with the support of a qualified legal advisor or tax lawyer. Establishing the trust may involve specifying the term of the trust and any beneficiaries. Once established, you can make a cash or non-cash contribution to the trust.

2. Donor may be eligible take a partial tax deduction on their contribution

After the trust has been established and funded, you may be able to use your contribution to reduce some of your annual gross income (AGI) and take an immediate tax deduction. Similarly to charitable lead trusts above, the deduction amount may vary based on how the trust is structured.

3. The trust distributes income payments to the donor or their beneficiaries

For the duration of the trust’s term, which may be equal to your or your beneficiary’s lifetime or up to 20 years, you or your beneficiaries can receive a stream of income from the trust. The size of these payments may depend on whether the CRT is structured as a charitable remainder annuity trust (CRAT) or charitable remainder unitrust (CRT).

Under a charitable remainder annuity trust, the income payments are equal to a specific dollar amount each year which must generally be at least 5% and no more than 50% of the value of the trust when established, per the IRS. Under a charitable remainder unitrust, income payments are a percentage of the value of the trust each year and will be impacted by market conditions for non-cash assets. Payments must generally be at least 5% and no more than 50% of the fair market value of the trust fund.

4. After the term, the remaining trust funds are transferred to qualifying charities

At the end of the term, the remaining funds are distributed to one or more IRS-qualified charities. Per the IRS, this charitable contribution must be at least 10% of the initial value of the trust’s funds. Note that while the funds are irrevocable, the donor may be able to modify charitable beneficiaries after the trust has been created.

Pros and cons of charitable trusts

A charitable trust can be a tax-efficient way of supporting charitable causes while also ensuring a stream of income payments over a period of time for yourself or your beneficiaries. While the specific tax advantages will depend on the type of trust you establish and your individual situation, here are some general advantages associated with certain types of charitable trusts:

- You may be eligible to take a partial tax deduction on your contributions.

- You typically will not owe capital gains tax on any appreciated assets in the trust.

- You or your beneficiaries may receive a steady income payment from the trust, depending on the type of trust.

- The funds you donate to a trust will reduce your total estate value once transferred.

- You will leave a long-term legacy of philanthropic impact.

On the other hand, there are some potential disadvantages to consider when evaluating whether a charitable trust could be right for you:

- It’s irrevocable, so you may not be able to modify aspects of the trust or the funds within it once established.

- It requires the support of a tax and/or legal professional to establish a trust.

- The tax status of trusts are complex and may not be the most tax-efficient giving strategy for your individual situation.

- Distributions from the trust to you or your beneficiaries may be taxable as ordinary income.

This content is for informational purposes only and should not be construed as legal, tax, investment, financial, or other advice. Nor does this information constitute an endorsement or recommendation of any financial institution or an offer to buy or sell any securities or other financial instruments. The investments or other strategies mentioned herein do not take into consideration your particular investment objectives, financial situation or needs and may not be suitable for you. You must make an independent decision regarding any financial or investment strategies mentioned herein and should consult a legal, financial or investment advisor before making any financial decisions.

FAQs about charitable trusts

Why create a charitable remainder trust?

Charitable remainder trusts can help you plan ahead for major donations to charities you support while providing financial security via a predictable income stream for life. The tax benefits include the ability to defer income taxes on the sale of assets transferred to the trust and potentially a partial charitable deduction based on the value of charitable interest in the trust.

How does a charitable trust work?

Charitable trusts are established to make donations to the charitable cause of your choice over an extended period of time. Once a trust is funded, the donor may be eligible to take a partial tax deduction on their contribution. Depending on the type of trust, the funds will then be distributed over time, both to an IRS-qualified charity or charities and back to the donor or their beneficiaries.

What types of charitable trusts are there?

Charitable lead trusts (CLTs) and charitable remainder trusts (CRTs). Within both of those, there are grantor and non-grantor trust types and annuity and unitrust types.

Do charitable trusts pay taxes?

According to the IRS, a charitable trust is not tax-exempt. Tax implications and benefits will vary based on the structure of the trust, but typically trusts are not subject to capital gains tax.

How much income can I take from a charitable remainder trust?

According to the IRS, income payments should be between 5% and 50% of the value of the trust when established (for annuities) or at fair market value (for unitrusts).

What funds can be used to establish a charitable trust?

Cash or non-cash assets like investments, real estate, and public or private company stock can be contributed but may have specific tax implications.

Can I take assets out of a charitable remainder trust?

No – once assets are added, they are irrevocable and cannot be taken back.

What are the individual tax filing obligations for charitable remainder trusts?

Beneficiaries must report payments received from the trust on their income tax returns. This is reflected on Schedule K-1 (Form 1041), ‘Beneficiary’s Share of Income, Deductions and Credits’.

What reporting obligations does the trust have?

Charitable remainder trusts must annually file a Form 5227, Split-Interest Trust Information Return. Form 5227 contains information about the trust’s financial activities and payments made to beneficiaries.